Portfolio Genius

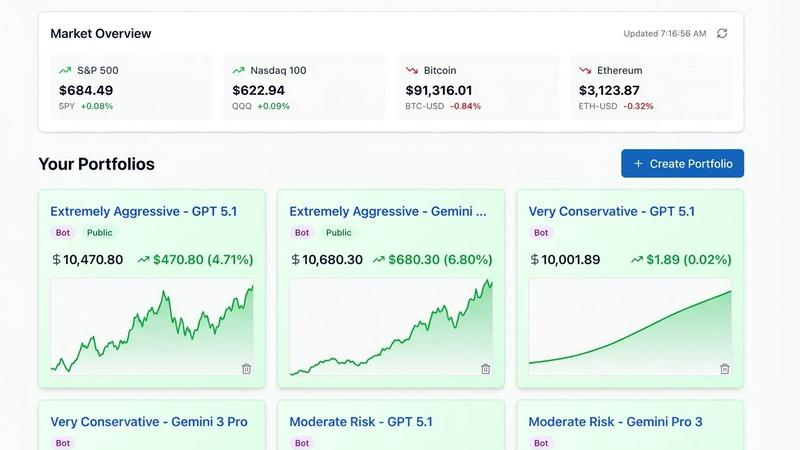

Portfolio Genius is an AI-powered investment advisor that analyzes markets and manages your trades.

Visit

About Portfolio Genius

Portfolio Genius is a sophisticated, API-driven AI portfolio management platform engineered to provide institutional-grade analytics to individual investors and traders. It functions as a smart portfolio tracker and management tool that continuously analyzes your holdings by integrating real-time market data, financial fundamentals, and AI-powered news processing. The core value proposition lies in its multi-model AI architecture, which allows users to leverage different large language models (LLMs)—specifically GPT, Claude, or Gemini—to generate trade suggestions and strategic insights tailored to specific investment styles. The platform is built for seamless integration, offering both a conversational chat interface for natural language queries and direct brokerage connectivity, such as with Alpaca, for automated trade execution. It is designed for a wide technical audience, from beginners seeking data-driven guidance to experienced traders and busy professionals who require automated, 24/7 portfolio surveillance and actionable intelligence without constant manual oversight. Security is foundational, with bank-grade encryption protecting all user data and portfolio information within its secure database infrastructure.

Features of Portfolio Genius

Multi-Model AI Analysis Engine

Portfolio Genius is architected with a flexible AI backend that supports integration with leading large language models, including OpenAI's GPT, Anthropic's Claude, and Google's Gemini. This allows users to select the AI that best aligns with their analytical preferences, whether for deep fundamental reasoning, concise summarization, or creative strategic exploration. Each model processes a unified data stack of real-time prices, financials, and news sentiment to generate trade suggestions with transparent, detailed reasoning for every buy, sell, or hold recommendation.

Automated Brokerage Integration & Trade Execution

The platform offers robust API-based integration with supported brokerages, most notably Alpaca. This enables a seamless two-way data flow: importing existing holdings for analysis and, when authorized, executing trades directly from AI-generated suggestions. Users can choose between a fully manual review process or enabling auto-trading, where the system can act on predefined strategies, effectively functioning as a programmable, AI-driven execution layer for a hands-off management experience.

Real-Time Portfolio Analytics Dashboard

The unified dashboard is a comprehensive tracking interface that aggregates data from global markets, including stocks, ETFs, and cryptocurrencies. It provides real-time analytics on performance metrics, position sizing, and portfolio health. A key technical component is the visual diversification analyzer, which breaks down asset allocation across sectors and asset classes, helping ensure technical portfolio balance based on live data feeds.

Conversational Interface & Portfolio Simulation

Beyond traditional UI elements, Portfolio Genius provides a natural language processing (NLP) layer via a conversational chat interface. Users can query their portfolio in plain English, ask for analysis on specific assets, or discuss strategy adjustments. Furthermore, the platform includes a non-committal portfolio simulator, allowing users to input hypothetical investment goals and amounts to test AI analysis and portfolio construction without any account creation or real capital.

Use Cases of Portfolio Genius

For the Hands-Off Investor Seeking Automation

Busy professionals or investors preferring passive management can utilize the full stack of Portfolio Genius: connect their brokerage account via Alpaca integration, select their preferred AI model, and enable auto-trading. The system then continuously monitors the market, runs analysis on the integrated data sources, and automatically executes trades based on the AI's reasoning, all while the user monitors performance through the secure dashboard and receives priority support.

For the Technical Trader Backtesting Strategies

Experienced traders can use the platform as a robust analysis and execution co-pilot. They can leverage different AI models to stress-test ideas, use the conversational interface to drill down into specific technical or fundamental queries, and manually review and act on AI-generated trade suggestions. The ability to manage multiple, separate portfolios with different strategies allows for isolated testing of aggressive, moderate, or conservative approaches in parallel.

For the Beginner Investor Learning Portfolio Management

New investors can start risk-free with the demo portfolio simulator to understand basic principles. By creating hypothetical portfolios and receiving AI-powered analysis on composition and risk, they gain educational insights. Upgrading to the Free or Premium plan allows them to track real or paper portfolios, receive weekly or daily AI reviews, and learn from detailed reasoning behind each suggestion, all within a secure, guided environment.

For the Analyst Monitoring Multiple Market Strategies

Individuals or small teams managing several investment theses can use Portfolio Genius's multi-portfolio functionality to segment strategies—like aggressive growth, dividend income, or crypto-focused—into separate portfolios. Each portfolio can be assigned different AI models or risk parameters. The leaderboard feature allows them to compare the real-time performance of these AI-assisted strategies against community benchmarks for continuous optimization.

Frequently Asked Questions

Does Portfolio Genius provide investment advice?

No. Portfolio Genius is a portfolio tracking, analytics, and educational platform. The AI-generated suggestions and analyses are informational tools based on integrated data processing. The platform is not a registered investment advisor, and its outputs should not be construed as personalized financial advice. Users are solely responsible for their investment decisions and should consult with a qualified financial professional for advice.

What data sources does the AI integrate for analysis?

The AI analysis engine is built on a multi-source data stack. This includes a real-time pricing service for stocks and ETFs, feeds for company financials and fundamental metrics, an AI news processing layer that performs sentiment analysis on market-moving stories, and a web search capability that surfaces the latest research and analyst reports. This aggregated data is processed within our secure Portfolio Database to generate insights.

How secure is my financial data with Portfolio Genius?

Security is a core architectural principle. Portfolio Genius employs bank-grade, end-to-end encryption for all data in transit and at rest. We utilize enterprise-level security standards to protect your portfolio information and personal data within our secure database. When using brokerage integrations, we adhere to strict API permission protocols, ensuring your credentials and account access are handled with maximum security.

Can I try Portfolio Genius without connecting a brokerage account?

Absolutely. You can start immediately with our free tier, which includes basic portfolio tracking and a limited number of AI suggestions. Most notably, you can use the portfolio simulation tool on our website without any sign-up required. This allows you to describe investment goals, use a hypothetical amount, and see a full AI analysis of a constructed portfolio, providing a complete demo of the platform's capabilities.

Pricing of Portfolio Genius

Portfolio Genius offers a simple, tiered pricing model with a focus on scalability and transparency, including a free tier to facilitate initial integration and testing.

Free ($0/month): The entry plan provides core functionality for basic integration, supporting up to 3 portfolios, weekly AI portfolio reviews, basic recommendations from a default AI model, and up to 10 trade suggestions per month. It includes community-based support.

Premium ($20/month): This is the full-featured plan for active portfolio management. It includes unlimited portfolios, daily AI reviews, access to all integrated AI models (GPT, Claude, Gemini), and unlimited trade suggestions. It unlocks key technical integrations like Alpaca brokerage connectivity for automated trading, along with priority support and early access to new platform features.

Premium Annual ($200/year): This plan offers the complete Premium feature set at a discounted annual rate, providing a saving of $40 (equivalent to 2 months free) compared to the monthly subscription. It includes all Premium benefits plus exclusive annual member perks and priority email support. All paid plans are backed by a 7-day money-back guarantee.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.