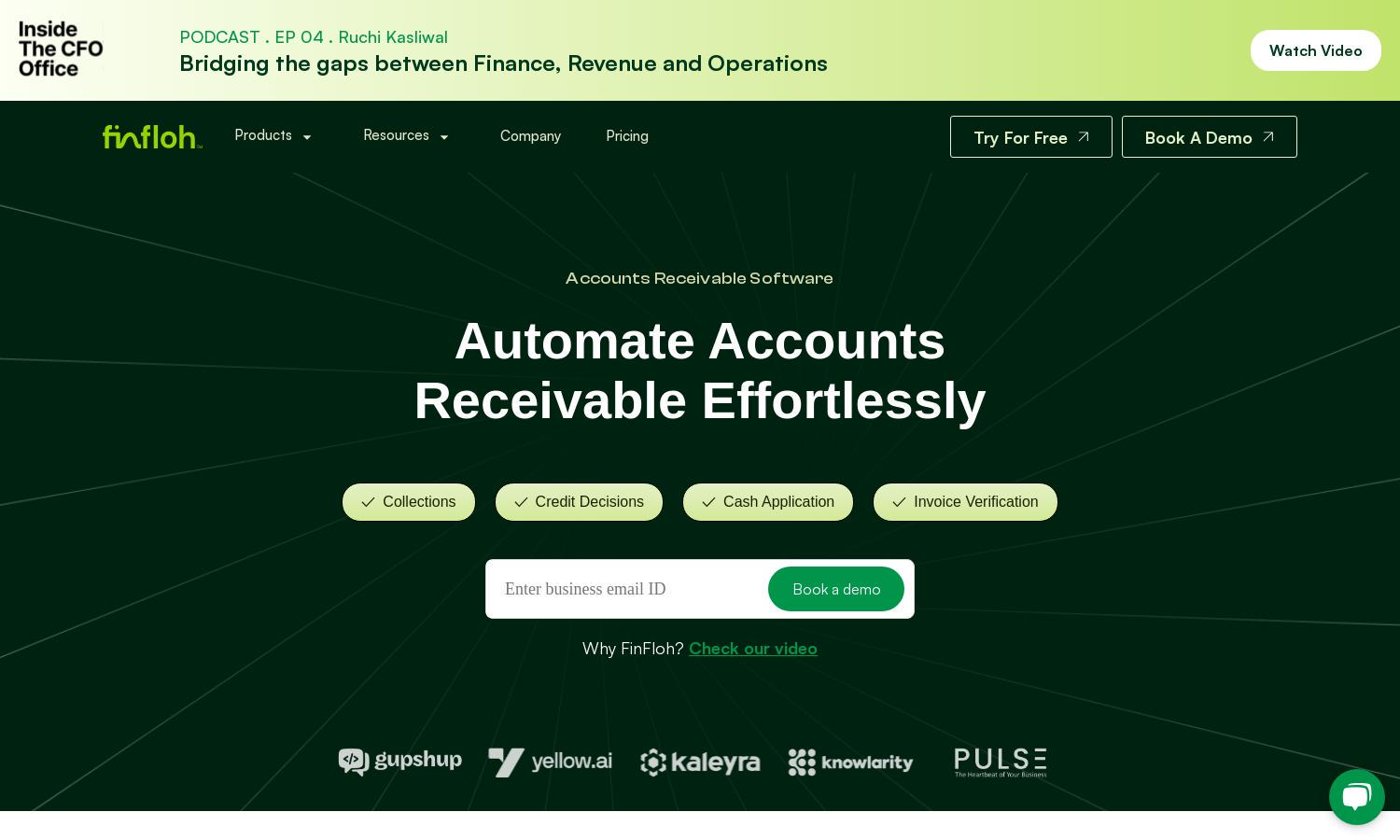

FinFloh

About FinFloh

FinFloh is a comprehensive accounts receivable automation platform aimed at B2B finance teams. It streamlines the entire receivables process, from invoice generation to cash application, enhancing efficiency through AI-driven insights. Users benefit from reduced DSO and improved cash flow management, making FinFloh essential for finance professionals.

FinFloh's pricing includes a one-time setup fee and an annual recurring fee, tailored to specific business needs. Customized plans ensure that businesses receive the best value, alongside benefits like reduced DSO and enhanced accounts receivable management. Contact FinFloh for a personalized quote and explore advantageous pricing options.

FinFloh features an intuitive interface designed for seamless navigation, featuring straightforward access to its powerful functionalities. Enhanced by real-time tracking dashboards and automated workflows, users can efficiently manage accounts receivable tasks. This user-friendly design ensures an optimal browsing experience, addressing the needs of finance teams effectively.

How FinFloh works

Users begin with FinFloh by signing up and integrating their existing ERP or accounting software. Onboarding includes a walkthrough of key features like invoice verification, automated cash posting, and dispute management tools. With a focus on collaboration, teams can access centralized communication channels, ensuring efficient workflow and enhanced decision-making. FinFloh’s AI-driven insights aid in transforming accounts receivable processes, ultimately increasing collections efficiency.

Key Features for FinFloh

AI-Driven Cash Application

FinFloh features an AI-driven cash application system that automates remittance aggregation, ensuring touchless matching with payment records. This unique functionality allows users to handle exceptions efficiently, thereby streamlining cash application processes and enhancing overall receivables management.

Predictive Dispute Resolution

FinFloh offers predictive dispute resolution capabilities that utilize advanced AI to assess and diagnose potential invoice disputes. This feature not only speeds up the dispute resolution process but also enhances communication between buyers and sellers, leading to improved cash flow management.

Dynamic Credit Scoring

FinFloh's dynamic credit scoring feature leverages AI to provide real-time credit assessments for buyers. This distinct capability empowers finance teams to make informed credit decisions swiftly, reducing risks associated with late payments and enhancing overall cash management.

You may also like: